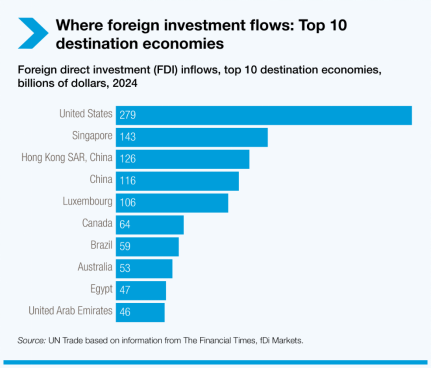

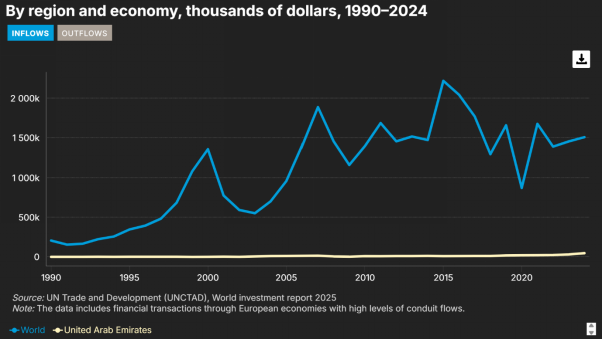

The UAE ranked among the world’s top 10 destinations for foreign direct investment (FDI) in 2024, as inflows surged by nearly 49 per cent to reach $45.6 billion (Dh167.6 billion), up from $30.68 billion the previous year, according to a United Nations report.

The World Investment Report 2025 by the UN Conference on Trade and Development (UNCTAD), revealed that the UAE climbed from 13th place in 2023 to 10th place in 2024.

The UAE accounted for 55.6 per cent of total FDI inflows into the Middle East, which received $82.08 billion in 2024 – an increase from $78.39 billion the previous year. Other major recipients in the region included Saudi Arabia ($15.73 billion), Türkiye ($10.59 billion), and Oman ($8.68 billion).

Sheikh Mohammed Bin Rashid Al Maktoum stated: “In an international vote of confidence in the UAE’s economy, the latest report by the United Nations Conference on Trade and Development (UNCTAD) revealed that the UAE attracted Dhs167 billion ($45 billion) in foreign direct investment over the past year, marking a 48% growth compared to the previous year.”

“The UAE accounted for 37% of all foreign direct investment inflows into the region. Out of every $100 invested in the region, $37 comes to the UAE. The country also ranked second globally, after the United States, in the number of newly announced foreign direct investment projects. Our next goal is to attract Dhs1.3 trillion in foreign direct investment over the next six years, God willing,” His Highness added.

Moreover, UNCTAD stated: “A strong rebound of flows in the UAE helped lift sub-regional figures, even as flows to Saudi Arabia and other Gulf Cooperation Council countries declined.”

The UAE’s outward FDI also saw moderate growth, rising by 4.8 per cent to reach $23.4 billion in 2024.

Focus on FDI diversification

The UAE has been consistently focusing on boost FDI as part of its efforts to diversify its economy away from hydrocarbons.

The Emirates attracted $30.68 billion of FDI inflows in 2023, compared with $22.73 billion in 2022, an annual growth of 35 per cent, the UNCTAD said in its 2024 World Investment Report in June. FDI outflows from the country stood at $22.3 billion, compared with $24.8 billion in 2022.

With regards to the cumulative FDI balance, the UAE has “significantly outpaced global growth rates” in the decade through to end of 2023, according to UAE Ministry of Investment data.

To boost FDI, the UAE has unveiled several initiatives including 100 per cent foreign ownership of companies, reduced visa restrictions and incentives for small and medium enterprises. It also unveiled the NextGen FDI programme, which seeks to streamline licensing, support the issuance of bulk or golden visas, improve banking and financial services, and provide leasing incentives for technology companies seeking to relocate to the country.

Trade deals

The UAE’s push to sign a series of Comprehensive Economic Partnership Agreement with its partners around the globe has also helped to boost FDI attraction.

Launched in 2021, CEPA deals reduce tariffs and remove trade bottlenecks and boost bilateral investment in priority sectors.

Access the full UNCTAD report here.